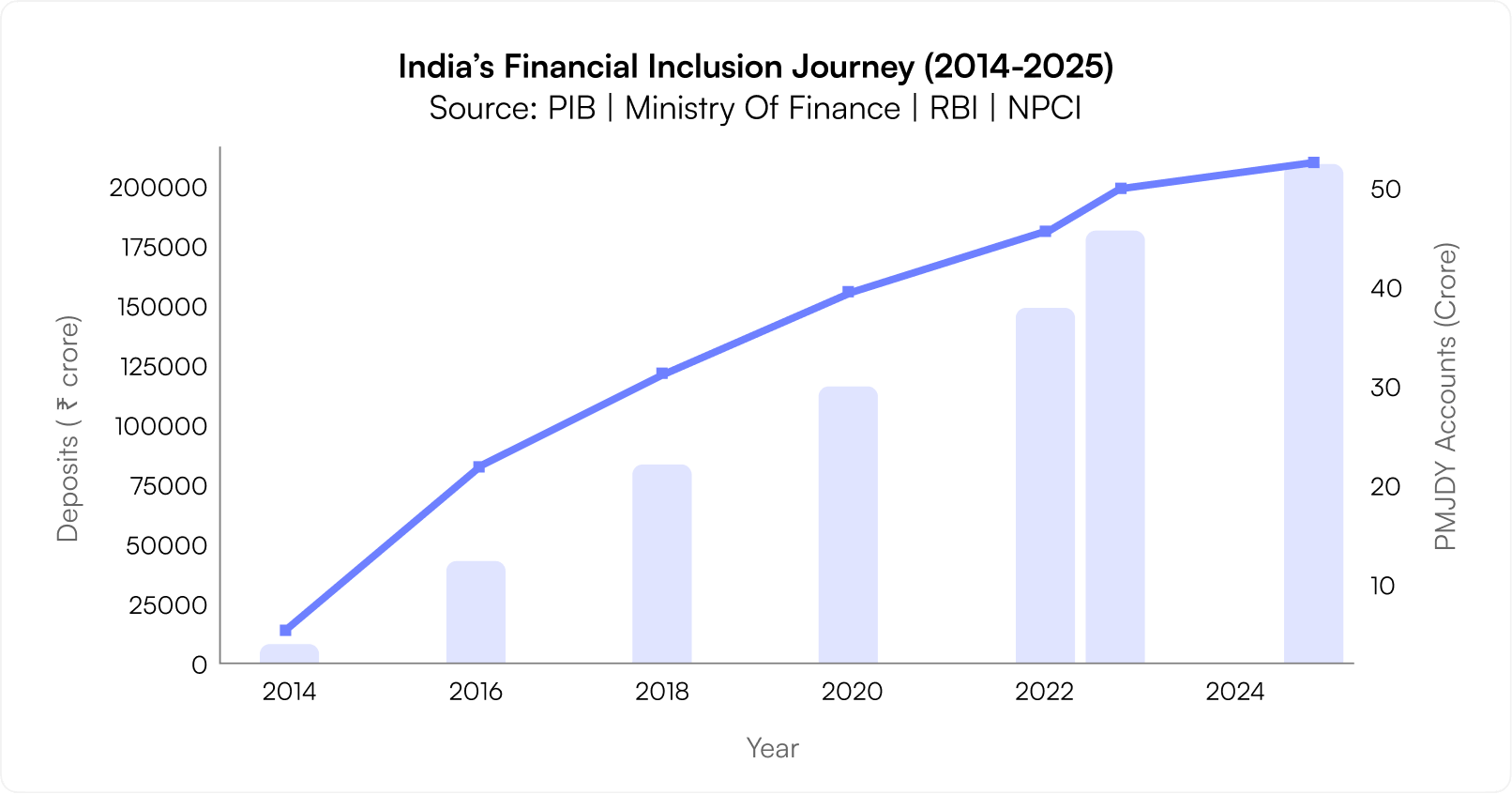

India’s financial revolution has come a long way from its first chapter — access. The launch of the Pradhan Mantri Jan Dhan Yojana (PMJDY) in 2014 marked a turning point, enabling millions to join the formal financial ecosystem for the first time.

As of December 2023, more than 51.04 crore PMJDY accounts had been opened, holding deposits worth ₹2,08,855 crore, according to the Press Information Bureau.

Yet, as the nation’s financial inclusion story matures, a new focus has emerged: empowerment. The next phase isn’t about opening more accounts, but ensuring these accounts enable individuals to save, invest, borrow, and transact with ease. The goal is to evolve from basic inclusion to intelligent participation — where every citizen can make informed financial decisions backed by technology and accessibility.

Financial Inclusion: The Foundation of Empowerment

The PMJDY’s success in expanding access has been remarkable, but the data reveals an important caveat. By December 2023, around 10.34 crore PMJDY accounts remained inactive, holding deposits worth ₹12,779 crore.

This highlights a crucial challenge: inclusion is only meaningful when it’s active. Financial literacy initiatives and incentive-based programs are being rolled out to encourage people to use these accounts more effectively — whether for savings, insurance, or digital payments.

Empowerment, therefore, is not just about being part of the system but knowing how to benefit from it.

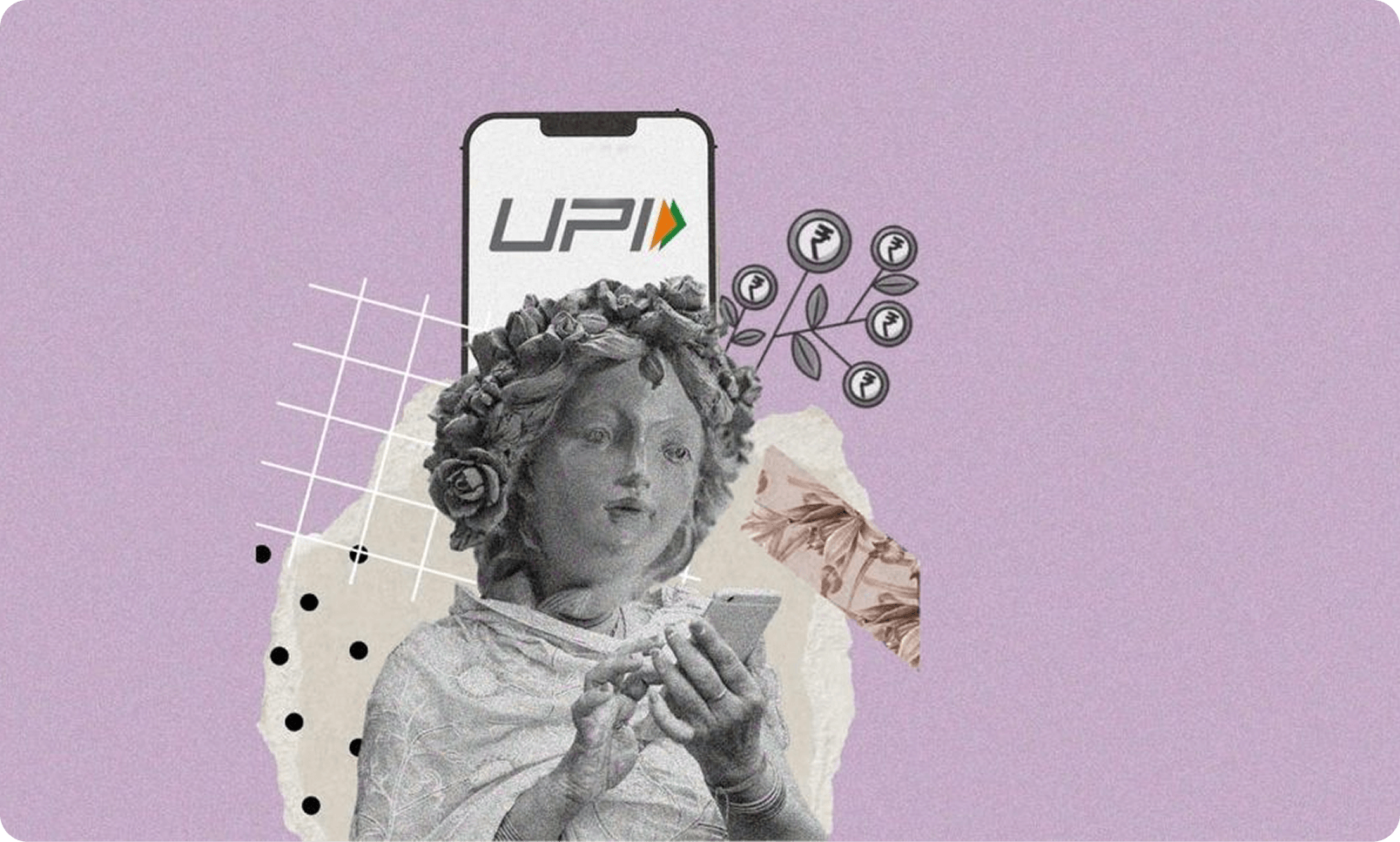

Digital Payments: Bridging the Urban–Rural Divide

The rise of the Unified Payments Interface (UPI) has been the defining story of India’s digital finance journey. What began as an urban convenience has now become a nationwide phenomenon.

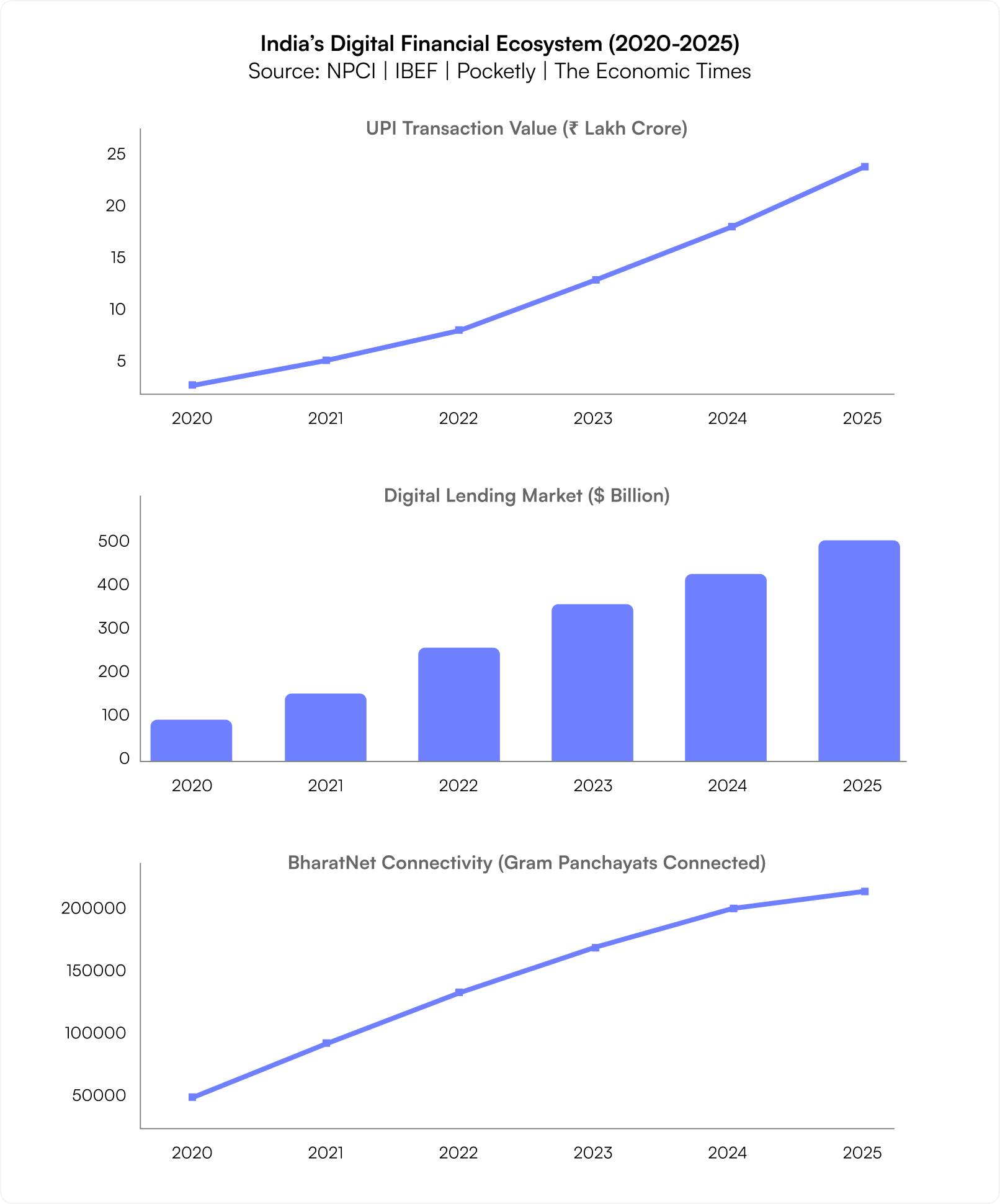

By 2026–27, daily UPI transactions are expected to touch 1 billion (Payment Insights), underscoring the platform’s unmatched reach and reliability. The government’s recent push for UPI integration in schools (The Times of India) and expansion of micro-ATMs (BusinessWorld) are bridging the urban–rural divide in digital adoption.

Today, a farmer in a remote village and a trader in a metro city share the same payment infrastructure — a rare equalizer in a country as vast and diverse as India.

Digital Lending: Credit at the Speed of Technology

Credit accessibility — historically a challenge in rural and informal sectors — is being reimagined through digital lending. Fueled by Aadhaar, UPI, and e-KYC infrastructure, India’s digital lending market is projected to reach $515 billion by 2030 (Pocketly).

Rural credit, too, is being redefined. The pilot project to digitize the entire Kisan Credit Card (KCC) lending process (The Economic Times) is enabling farmers to secure loans with minimal paperwork and faster disbursements.

Technology is not just simplifying lending — it’s democratizing it.

Neobanks: The New Face of Financial Intelligence

India’s digital-native generation is reshaping banking expectations. For them, finance is not a place you visit — it’s an experience you live on your phone.

Neobanks, with their app-first approach, are at the forefront of this evolution. The global neobanking market is projected to reach $156.47 billion by 2032, and Indian startups like Open and Jupiter are leading the way.

Offering everything from budgeting tools to investment products, these platforms are creating personalized, intelligent financial ecosystems that evolve with users’ needs.

Rural Connectivity: The Backbone of Digital Empowerment

Behind the success of financial digitalization lies a less visible but equally critical infrastructure story — connectivity.

Under BharatNet, over 2.14 lakh gram panchayats have been connected via optical fiber cables, Wi-Fi hotspots, and FTTH connections as of December 2024.

This digital backbone supports not just banking but education, healthcare, and commerce — ensuring that India’s digital revolution reaches every corner of the country.

Conclusion: From Access to Empowerment

India’s financial evolution is no longer about counting new bank accounts. It’s about measuring participation, empowerment, and progress.

From Jan Dhan to UPI, from neobanks to BharatNet, the country is building a financial ecosystem that is inclusive by design and intelligent by intent.

The journey from inclusion to empowerment marks not just a policy success, but a social transformation — one where every Indian can not only access the system, but thrive within it.

Team Axe

Markets move on stories as much as on numbers. Team Axe looks at both — the data underneath and the narrative on top — to show which themes are durable and which are just this week’s excitement.